Customer Profiles

Spotlight on Payroll Services: An interview

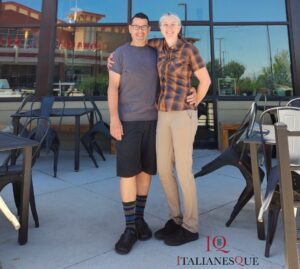

Paula Waddle, co-owner of Italianesque restaurant

We caught up with Paula to talk about Italianesque. Our thanks to Paula, Tim and Italianesque for being client partners of QTS.

Tell me about Italianesque.

We’re a family-owned and operated restaurant. Tim, my husband, has been a chef for over 30 years and I came along on the ride. Although I had some restaurant experience in the past, most of what I’ve learned about being a restaurant owner I learned from him.

We opened the restaurant in February 2020, about 3 weeks before the world shut down with COVID. That definitely put uncertainty into things. However, because we were first time business owners, there was already plenty of uncertainty.

Our son and daughter were helping to get the business off the ground. My daughter-in-law and I still had other jobs so we called ourselves the “sugar mamas” and were supporting the others while they worked on the restaurant. This made the COVID issue somewhat less stressful. As we hadn’t really gotten the restaurant rolling yet, we didn’t have staff at the time and were only paying a salary to our daughter. Moneywise, that really helped us. My husband said, “We were too young and naive to know better.”

Three weeks after opening, we were starting to pick up speed and people were finding us, then we had to shut down the dining room for 2 months. My husband did an amazing job at pivoting. He put together home meal kits from our menu, for example, a family chicken alfredo dinner. People bought these for putting in the refrigerator or freezer. We also had a childhood friend who ran a food distribution hub where people could place orders and we were on that list for meal sales. Carry out orders of fully-prepared meals also continued. We tried to be as creative as possible in coming up with ways to produce revenue even when the restaurant was closed. It paid the bills.

How many staff are working at the restaurant?

We have 10 right now, but it can fluctuate a lot. Most of them are teenagers. We chuckle and tell people we run our own youth group. They’re great hardworking kids we know from the neighborhood or who go to the same school. We hope we’re giving them experience for future jobs. It’s a happy-sad moment when someone leaves us for that reason.

When did you start with QTS?

It was in early 2020 when we wanted to get our daughter on the payroll. I didn’t have experience in that part of operating a business and it gave me anxiety thinking about it, especially the payroll taxes. We talked with Breck and explained that we were teeny tiny. A lot of vendors would have said, “You’re too small, we only handle large companies.” or “You can’t do it yourself?” Breck said, “We can help you,” and walked us through the entire process. We were so grateful. It’s made all the difference having QTS do payroll for us and takes that job off our plates. When you’re working in the restaurant, you don’t have time to work on the restaurant. Right before this conversation, for example, I was making tiramisu for tonight’s dinner menu.

The thing that has impressed me the most with QTS is the accessibility of assistance. I can shoot an email to the QTS team with a question. They don’t just say, “I can fix it,” or send instructions. They provide screen captures of each step so I see how to do it myself. The responses are also very quick which is fantastic.

What do you consider when working with a provider?

Affordability is one. As a small business, we carry all the overhead. We don’t have investors unlike some other restaurants. We’ve bootstrapped from the start and immediately had to begin focusing on profitability. Restaurants with outside financial backers don’t have that same level of pressure.

With QTS, it was affordability, but the real bonus was the access to help. I’ve had absolutely no negatives since coming onboard with QTS.

How do you rank affordability vs. service from a provider?

We always evaluate the true value we receive from a vendor and ask, “Is the cost worth the value we get?” It’s what we do all providers. We’re now on our third credit card processor, for example. We finally found one that has the same level of service as QTS. For us, it’s assessing cost to value.

If you were to talk with other businesses about payroll, what would you tell them?

Truth be told, I just did this. We recently had a guest at our restaurant who told us about her new construction company. Although she had handled her own payroll in the past, she was stressing about it now with all the other work needed to get the business off the ground. She said, “Payroll is coming up next Friday and it’s making me crazy.” I said, “Let me tell you about the folks I work with.” I told her exactly what I told you, “The cost is reasonable and the access to help is great.” That company is now on board with QTS.

Spotlight on Payroll Services: An interview

Denice Wood, General Manager,

Raven Golf Services

We greatly appreciate the long working relationship we have with Denice and Raven Golf Services where she oversees all operations. We caught up with her for a conversation.

Tell me a little about Raven Golf Services.

We manage golf courses. The company was founded in 2009 and we’ve been responsible for many different courses during that time. Currently, we manage the River Birch Golf Course.

Our business is seasonal so our employee count fluctuates. Right now, we have 59 employees on the payroll, although in the winter, it drops to about 25. In the past, we’ve managed up to five courses at the same time so had many more employees.

What has been your experience with QTS?

We’ve worked with QTS for a long time; I believe we started in about 2013. We use payroll plus the time and attendance services. Our experience has been really positive overall. As with anything, sometimes there have been hiccups, but customer service is there is help. When we were managing five courses, logistics sometimes got complicated. In addition, Breck and Rick have always been available and helped take care of things right away, such as making sure time clocks were up and running for our multiple courses. That’s been very valuable to me. Now that I have only one course, it’s a breeze.

I also figured out how to build custom reports which is really nice. Although there are a bajillion reports available on the QTS system, I wasn’t sure which provided the specific information I wanted. In the past, I asked customer service and they would send me the report. I thought, “Why not save time for everyone and do it myself?” I did it on my own as I had experience with a similar system, but suggest that training may be helpful for other companies that want to set up custom reports themselves. It’s really simple when you know what to do. This has been very helpful.

Why do you stay with QTS?

It works. Data is very important to me. If someone asks me for historical information, I want to be able to go back and find that information easily. I can do that now.

During our time with QTS, I’ve been approached by many other payroll companies that have asked me to switch. They say they’ll do this and they’ll do that, and will match pricing. Before QTS, I worked with two other payroll companies. One was the largest payroll company in the nation. I did that for a year and was so frustrated I had to get out. They couldn’t get my reports correct. I had to do it all manually.

What are some of the most important considerations in working with a provider?

Accuracy. Plus trust. Trust that my provider will take care of it. That was the problem with another payroll company I used in the past, also a national company. I paid our taxes to them and somehow those tax payments didn’t make it to the state. It was extremely frustrating. I need to be able to trust that things like this will get taken care of. It does with QTS.

I also like that QTS handles garnishments so I don’t have to wrack my brain over it. I’m very good at the things I do everyday, but I don’t want to figure out those which happen only once in a while. At QTS, it gets done.

What about cost versus service when working with a provider?

That’s always a tough question. I’ve done the entire job myself in the past. I know how to do it, but I don’t like to do it. Just for the tax purposes and related tasks alone, it’s peace of mind for me. I know it’s getting taken care of. It’s worth what we pay.

Is there anything you’d like to say to other golf courses?

Things are clicking along fine. Customer service at QTS is great and there are no concerns with things like accuracy. They do a great job.

Spotlight on Payroll Services: An interview

Janice Skinner, Controller/Business Manager

Sockeye Brewing

Sockeye Brewing is a long-time client partner of QTS Custom Payroll. Janice oversees all business operations for the company. We caught up with her for a conversation about her QTS experience.

Tell me a little about Sockeye.

Sockeye Brewing just celebrated its 27th year in business. We have two locations: one is our flagship grill and brewery and the other is the Sockeye Alehouse, a new full-service restaurant with a pub and a 9-hole putting green that opened in March. We’re very proud of it. There are about 185 employees between both locations.

QTS has been our partner since 2015 and we use the payroll, scheduling and employee onboarding services.

What are the most time-consuming aspects of your payroll?

One of the biggest challenges in this type of business is the turnover. We do a bi-weekly payroll and every pay period, we onboard 5 to 10 new employees and terminate others. It would be a real hassle to onboard manually with that many changes. It was huge for us when we discovered QTS’ online onboarding as it cuts our time to less than half for this task. With the digital onboarding portal, employees enter and update their own data, and look up information when they choose without asking us.

When working with a service provider, what are your most important considerations?

Balancing service and value is a priority for me. I don’t need flashiness, I need customer service and cost savings. Of those, customer service is the priority. QTS provides by far the best support I receive from any of the platforms I use, including my accounting and restaurant software. If I have an issue, I get in touch with QTS client service and get quality support almost instantly. I always have a response in less than an hour. Based on the situation, there may not be a solution at that time, but they continue to work on it and keep me updated until there is one. Other vendors sometimes take 2 to 3 days just for a call back.

Why do you stay with QTS?

I’ve been impressed with QTS across the board. Usually, I call QTS to ask about something and they say, “Yes, we have it. Let’s set it up for you.” If they don’t have it, they work with me to get it done.

By far, QTS is the best value for the money. They have everything I need and the cost is quite a bit less than the competitors.

Would you recommend that other breweries and restaurants use QTS?

I make recommendations for things I believe in and absolutely recommend QTS to others. I’m part of a Facebook group for restaurant owners and managers and have had direct conversations with other members about QTS and the reasons why I use it, and pass along Breck’s name and number.

In this group, we also have candid conversations about the restaurant POS app that many of us use. It recently added a payroll and scheduling component it acquired from another company. I demo’ed it twice, thinking it may streamline my process, but there is a lot of room for improvement. It is not as seamless as portrayed so maybe the payroll process is too much to handle. Each time I looked, I determined that it would be much more work for me than continuing with QTS. Instead, I worked with the staff at QTS and they helped me set up reports and export files to coordinate with the POS system. In fact, I found QTS easier to integrate with the POS system than the payroll and scheduling software the POS company provides.

I feel very confident suggesting QTS and would also recommend it to someone doing payroll in another industry.

Why do you stay with QTS?

My top 3 reasons for staying with a vendor are amazing customer service, value and quality of the product. It’s what I receive from QTS.

I love QTS. I get phenomenal service and refer them to others every chance I get.

Spotlight on Payroll Services: An interview

Tawni Maxwell, Owner, SimpliBalanced

Nyssa, Oregon

Could you describe the SimpliBalanced business?

We are a bookkeeping business serving western Idaho and eastern Oregon. some of our clients include contractors, produce sheds, cleaning company, farmers and other agriculture-related businesses. It’s a diverse group. Bottomline, employees are employees. We’ve been working with QTS since 2015. We love it, especially Breck, Carl, John, Shantel and Linda!

What are some ways that working with QTS supports the way you do business?

The biggest is peace of mind about payroll taxes. The QTS tax department is amazing! The staff is very knowledgeable, helpful, kind and so great to work with.

Oregon is not an easy location to do business, but QTS handles it with no problem. They stay up to date on it all. If you get a notice of any kind, all you do is forward it to the tax department and they take care of it. That’s peace of mind!

Handling payroll taxes is obviously an important way QTS is helping you to manage your business. Are there other reasons you use QTS?

Yes, how quickly payroll can be uploaded. We can import data right into the payroll system in about 3 minutes. With multiple employees, you don’t have to pull up each person and enter their hours separately. It’s quick and easy.

A little more about how our business integrates with QTS: our customers have from 1 to 70 employees, and work in multiple states. Each company has its own client profile within the QTS system so all information is separate and distinct only to them. Each payroll is set up specifically as to how the employer wants to pay, whether it is monthly, weekly, salary, hourly or many other options. We, as the bookkeeping company, have access to all of the clients from one window and we choose which company to work on.

How do you weigh cost versus service when choosing a service provider?

We use QuickBooks for accounting, but we don’t use their payroll component because QTS customer service is so amazing.

QTS is very cost effective, but it’s really the customer service that does it for us, especially being able to call and talk with someone. I actually went to Las Vegas to the QTS office to meet them face-to-face. They are so kind and that’s who we want to do business with. I really love and appreciate them. That is the reason we use QTS for our own company and as a standard part of the package for our bookkeeping clients.

We greatly appreciate our long partnership with you and your business. What is the primary reason you’ve stayed with QTS?

Bottomline, it is the ability to get a real person right when you need them. QTS really makes every part of it easy for customers. With the initial set up, they go above and beyond, helping you collect your information, entering into the system and getting started. Payroll is not a big deal when you have QTS.

Sometimes people don’t believe it when I say it’s so simple. They don’t think it’s possible. The team there will do whatever it takes and help with everything from reports to putting information into the system so that it’s set up correctly from the beginning. I can’t say enough good things about them. I tell people, “If you have employees, QTS is your go-to payroll company.” They’re awesome!

Spotlight on Payroll Services: An Interview

Carmen Weyland, CPA, Owner

Fit Books Accounting

How do you use QTS payroll for your clients?

The way I use outsourced payroll is not unusual for accountants today. Many CPAs used to process payroll in-house for clients as a regular part of business. Now, with cloud-based payroll, clients can easily process their own payroll. I work with the data coming from the payroll company and enter it into the accounting system and help my clients monitor labor costs. QTS has reports so I can easily import the payroll details in the accounting system each pay period. I am able to minimize transactional work and spend more time working with clients on managing costs and cash flow.

I recommend to all my clients that they outsource payroll processing. The payroll provider and services they provide to me and my clients are important to timely payroll processing, accurate tax filings, reliable customer service and accounting efficiencies. I’ve been working with QTS for many years, starting in 2015. I recommend QTS to my clients. There is no incentive program for me to do so. They are great to work with and have excellent customer service.

Why do you recommend an outsourced provider?

Precision in payroll and related issues are so important that I require my clients to use a professional outsourced provider, rather than doing it in-house. Payroll is very complex and the risk of error is high, especially if the company is multi-state as each jurisdiction has different filing requirements. Every state has a minimum of two government agencies that require registration, for example. This is a big mystery for many clients and the penalties which can be levied for errors often exceed the cost of the outsourced provider, not to mention the headaches and time needed to handle these issues.

Outsourced payroll with a high-quality provider provides a solution to what otherwise can bring huge problems to a company.

Are there differences between payroll companies?

Big name brands don’t mean that it’s the right provider or the right services. Some companies use the payroll component that comes built into their accounting software. It requires integration which can be a nightmare. Clients call me if they have a problem with their payroll companies so I know what issues they’re having and who it’s with. Hold times of more than 2 hours to talk with someone for logging an issue are not unusual.

There is definitely a difference between payroll providers. Some of the biggest names in payroll have smoothly-operating, glossy-looking software, but it is expensive, even with the free services usually offered. There is also very poor customer service. QTS is a smaller provider which makes it ideal for many of my clients. The service and support is outstanding, combined with a price that is really good.

For example, I’ve never been put on hold when calling QTS. The service by phone or by email is extremely responsive. Even by email, I get a response within 15 minutes. I absolutely love them. Their very fast response is worth so much to me. I don’t have time to be on hold for 30 minutes or more. With the other companies, my issue often gets elevated to another level which means more time on hold. With QTS, my problems usually get addressed on the first call. I really like that I – or my clients – can call and someone actually answers the phone. It’s rare.

What is one of the biggest payroll challenges for small business?

The focus of most company owners is on growing their business. They’re not knowledgeable about payroll nor the complexities of integrating software. With the labor shortage, accounting departments are struggling to find staff. Outsourcing relieves them from these headaches and the risk of costly errors due to lack of experience. With an outside payroll company, I can make a journal entry between payroll and accounting and be sure the imported data is correct.

Another problem for businesses is that they often don’t know if something is wrong until it is too late. One of the biggest issues is local, state and federal filings. If done incorrectly, it can cause a lot of misery. QTS has systems in place to handle this and they know what they’re doing. Not only is it much more efficient, both the business and I know it’s done right.

Bottomline, QTS services and its excellent customer service helps to solve the payroll problems of small employers.

What else?

My clients get frustrated that the big payroll companies are now into other types of products and services, which they are continually upselling. Small companies usually don’t need those services. In addition, it adds to the baseline cost. QTS is very focused on doing payroll and doing it well, and finding the right solution for their clients with stable pricing. Adjustments are modest when they do occur. The name brand services are expensive plus the prices increase frequently.

Why do you recommend QTS to your clients?

In my business, I focus on providing value-based outsourced accounting services and financial and operational strategy, working in collaboration with company management and any in-house accounting staff. The focus is helping company owners accelerate results and achieve business objectives. Maintaining focus on what is important in their overall finances is essential. Bottomline, QTS helps me do my job better in serving my clients. Thank you, QTS.

Spotlight on Payroll Services: An Interview

Barb Aberg, Senior Staff Accountant

United Way of Treasure Valley

Tell us about your payroll and how you first started working with QTS.

The United Way of Treasure Valley has worked with QTS since early 2016. Our organisation has 15 employees in the Boise office and we run a bi-weekly payroll.

My payroll experience is quite extensive as I worked for a small tax firm before United Way where I ran payroll for 12 other firms. I knew it didn’t have to be this difficult. It’s when we decided to look for a better option and that’s when we found QTS.

Some companies think that changing payroll providers is a big hassle. What did you find?

It was very easy to make the transition to QTS, transfer the data and set up the payroll system. I worked with Nora to transfer the information – she was wonderful --- and Rino’s help in the transition was phenomenal. I received quick responses to my calls and, when there was a tax issue, Linda in the tax department was outstanding in helping us solve the problem. These employees are still at QTS and helping to solve problems.

In addition to the usual responsibilities of an accounting position, I also do many other jobs at United Way as we have a small office. This means I really rely on the professionals who work at QTS to keep my payroll running smoothly, especially when I am involved in other tasks. I love solving problems by phone. QTS is quick to get back to me and I receive one-on-one attention. This is not something I had at ADP.

What service attributes are most important for you?

In addition to QTS’ reliability, the team and customer service, the 3 things I like best are:

- Using the TimeTracker to capture employee’s daily work hours and details as the data imports directly into the payroll software. It saves time for me and for our staff members, and seamlessly keeps a timely and accurate record of hours. This is especially important with two locations and now the culture of people working from home.

- Employees can log in and handle many of their own HR and payroll-related tasks without contacting me. The ease of usability of the QTS system is very important in making that happen.

- QTS is continually making enhancements to its software to make the job easier. I need to work fast because of my different hats and my work is often heavy on the benefits side. As we don’t have an human resources person, I handle all on- and off-boarding, as well as accounts payable and budgeting. QTS helps streamline those tasks.

As I mentioned, customer service is a big deal to me, especially being able to reach someone easily and get an answer. I appreciate Breck and his quick responses and help whenever I call.

What about cost?

United Way is a non-profit so this is especially important. Pricing has been great. In the entire time we’ve been with QTS, there has been only one price change and it was minimal.

Is there anything you’d share with others about working with QTS?

I have found QTS to be tremendously helpful in all things payroll-related. Not only is it easy to use but it is also an affordable service that far outperforms its price point. The customer support and service are top-notch. Thank you, QTS, for being such a fantastic resource for our payroll and HR needs.

About United Way of Treasure Valley

United Way of Treasure Valley serves the community through its Boise office. The roots of the worldwide United Way organization formed in Denver in 1887 and in the Treasure Valley in 1928.

United Way of Treasure Valley provides a holistic approach to helping children and families in need. It improves lives by mobilizing the caring power of our community to advance the health, education, financial stability and basic needs of every person in the Treasure Valley (Boise, Nampa, Meridian and the surrounding region). By taking strategic action that does the most good for the most people, it works to address the root causes of inequality in its communities.

Spotlight on Payroll Services: An Interview

Jerry Kennedy, CFO

Catholic Purchasing Services

What were your most important considerations in choosing a new payroll provider?

Many people look only at savings. Although saving money is important, for me, payroll processing is not a huge expense in the budget; but there are other considerations.

What was really important to me was how easy it was to transfer to QTS and how much extra work would I need to complete. I was dragging my feet in making the change as it seemed a much bigger project in my head than in actuality. It really didn’t take any time at all to complete the forms and summarize the employee data.

Another key consideration was service from our previous provider – it was a large national company that we’d used for years and that many of our customers also used. It was often frustrating trying to connect with a representative when there was an issue. For example, if a special run was needed for a payroll adjustment, contacting a person took some time.

Our previous provider also asked us to switch internal platforms because the new platform would fit our company size. I thought, “Why do I need to change? If it’s not broke, why fix it?” There were minor changes in the new platform which took some time to learn. We also had to re-register all employees and make a few other changes. When we terminated our service, interestingly enough, there wasn’t a response or even any follow up from our previous provider. About that time, we also learned that other Catholic institutions had made a change away from the same provider.

At QTS, I dealt with one key person for training. If he wasn’t available, I was connected with another staff person for help. For example, in the first payroll run on my own, I sent an email to my contact, and received a return note that he was out of the office. That email gave me the names of two other individuals. Before I could even send an email, one of those individuals, Linda, called and said, “I saw your email, how can I help?” I thought, “This is great! It’s just what I need.”

What has been your experience since converting to QTS?

The initial set up was easy. Completing the forms and gathering info for the transition didn’t take long. The training documentation provided was simple to follow. The couple small issues we had – an incorrect address, zip code and employment classification – we fixed quickly and everything else was good. The QTS staff not only walked me through the first payroll but also how to set up automation.

I appreciate that there are multiple ways to get reports and that they are simple to find. The reports are also available quickly online without waiting. The system is intuitive --- I don’t have to hunt through different menus. I also have the ability to access everything from home, office or wherever I’m working that day.

A real benefit is that new direct deposit set ups go right through without having to wait. With our last provider, we had to wait for two weeks for direct deposit to become active.

Do you have suggestions for others who are considering making a payroll change?

I hope other organizations read about my experience and realize how easy it is to make a transition to QTS. Don’t get stuck in the old ways like I was. QTS is a good group, easy to work with and very responsive. No company is too big or too small for QTS.

Like to talk with Jerry for more information about his experience or have a conversation about payroll services for your institution? Get in touch.

Jerry Kennedy

Catholic Purchasing Services

800.237.4125 x 530

JKennedy@CatholicPurchasing.org

Breck Hansen

QTS Custom Payroll & HR Solutions

855.855.7999

Breck.Hansen@QTSPayroll.com

If your organization is a member of Catholic Purchasing Services, you may also contact:

Mary Schell O’Hara

800.237.4125 x 547

Mary@CatholicPurchasing.org

Get a quote today and your boss will love you forever!

Easy to Understand Pricing, Incredible Support, Scaleable Solutions, Guaranteed Savings