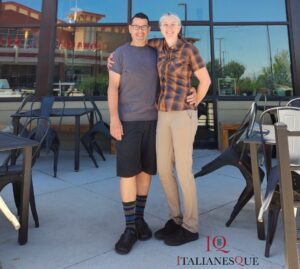

We caught up with Paula to talk about Italianesque. Our thanks to Paula, Tim and Italianesque for being client partners of QTS.

Tell me about Italianesque.

We’re a family-owned and operated restaurant. Tim, my husband, has been a chef for over 30 years and I came along on the ride. Although I had some restaurant experience in the past, most of what I’ve learned about being a restaurant owner I learned from him.

We opened the restaurant in February 2020, about 3 weeks before the world shut down with COVID. That definitely put uncertainty into things. However, because we were first time business owners, there was already plenty of uncertainty.

Our son and daughter were helping to get the business off the ground. My daughter-in-law and I still had other jobs so we called ourselves the “sugar mamas” and were supporting the others while they worked on the restaurant. This made the COVID issue somewhat less stressful. As we hadn’t really gotten the restaurant rolling yet, we didn’t have staff at the time and were only paying a salary to our daughter. Moneywise, that really helped us. My husband said, “We were too young and naive to know better.”

Three weeks after opening, we were starting to pick up speed and people were finding us, then we had to shut down the dining room for 2 months. My husband did an amazing job at pivoting. He put together home meal kits from our menu, for example, a family chicken alfredo dinner. People bought these for putting in the refrigerator or freezer. We also had a childhood friend who ran a food distribution hub where people could place orders and we were on that list for meal sales. Carry out orders of fully-prepared meals also continued. We tried to be as creative as possible in coming up with ways to produce revenue even when the restaurant was closed. It paid the bills.

How many staff are working at the restaurant?

We have 10 right now, but it can fluctuate a lot. Most of them are teenagers. We chuckle and tell people we run our own youth group. They’re great hardworking kids we know from the neighborhood or who go to the same school. We hope we’re giving them experience for future jobs. It’s a happy-sad moment when someone leaves us for that reason.

When did you start with QTS?

It was in early 2020 when we wanted to get our daughter on the payroll. I didn’t have experience in that part of operating a business and it gave me anxiety thinking about it, especially the payroll taxes. We talked with Breck and explained that we were teeny tiny. A lot of vendors would have said, “You’re too small, we only handle large companies.” or “You can’t do it yourself?” Breck said, “We can help you,” and walked us through the entire process. We were so grateful. It’s made all the difference having QTS do payroll for us and takes that job off our plates. When you’re working in the restaurant, you don’t have time to work on the restaurant. Right before this conversation, for example, I was making tiramisu for tonight’s dinner menu.

The thing that has impressed me the most with QTS is the accessibility of assistance. I can shoot an email to the QTS team with a question. They don’t just say, “I can fix it,” or send instructions. They provide screen captures of each step so I see how to do it myself. The responses are also very quick which is fantastic.

What do you consider when working with a provider?

Affordability is one. As a small business, we carry all the overhead. We don’t have investors unlike some other restaurants. We’ve bootstrapped from the start and immediately had to begin focusing on profitability. Restaurants with outside financial backers don’t have that same level of pressure.

With QTS, it was affordability, but the real bonus was the access to help. I’ve had absolutely no negatives since coming onboard with QTS.

How do you rank affordability vs. service from a provider?

We always evaluate the true value we receive from a vendor and ask, “Is the cost worth the value we get?” It’s what we do all providers. We’re now on our third credit card processor, for example. We finally found one that has the same level of service as QTS. For us, it’s assessing cost to value.

If you were to talk with other businesses about payroll, what would you tell them?

Truth be told, I just did this. We recently had a guest at our restaurant who told us about her new construction company. Although she had handled her own payroll in the past, she was stressing about it now with all the other work needed to get the business off the ground. She said, “Payroll is coming up next Friday and it’s making me crazy.” I said, “Let me tell you about the folks I work with.” I told her exactly what I told you, “The cost is reasonable and the access to help is great.” That company is now on board with QTS.